Practical sampling methods in research with examples

Find practical sampling methods in research and choose the best methodology for your next study

Inside this Article…

- Introduction:

- What is sampling?

- Sampling benefits

- What to consider when sampling

- Information you need to choose a sampling method

- Sampling methods used in Online Research

- Sample Size Calculator

- Sampling methods to consider for your study design

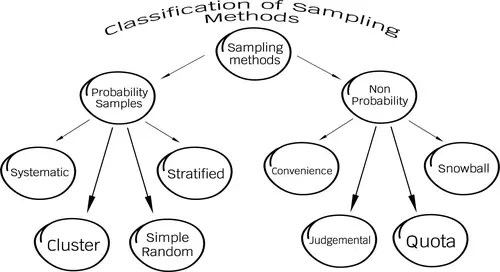

- Probability sampling methods: Simple Random, Cluster, Stratified, and Systematic

- Non-probability sampling methods: Convenience, Quota, and Judgemental

You might also like…

The Market Research Conference Circuit: Benefits & Challenges of a Crowded Calendar

There are many different market research conferences to pick and choose from in any given calendar month. What are the pros and cons of so many options? Inside this Article... Introduction Why Are There So Many Market Research...

Why Qualitative Research is Essential in Market Research (and How EthOS Elevates It)

Discover why qualitative research is such an important part of market research and how OvationMR's tool EthOS can help. By: Anne Collins Date: March 25, 2025 Inside this Article... Introduction Why Small Sample Sizes Still Deliver...

Introduction to Sampling Methods in Research?

The concept of sampling and its scope is as important as it is basic as a market research technique. The chosen samples must be representative of the universe with the precision as required. It sounds difficult until you learn the different techniques involved in sampling.

This article will provide useful insights into the common sampling methods in market research. But, before describing these methods, let us introduce some important concepts in this context.

What is Sampling?

Sampling is the set of techniques and steps to be taken to carry out the process of selecting the sample in an investigation. The basic function of sampling is to determine which part of a population should be examined to make inferences about that population

Does Sampling Have Benefits?

- The sampling costs are cheaper and more practical than reaching every member of a target population. It saves you money and time.

- With sampling, you have a higher degree of control with less complexity.

- A sample can be more accurate as it eliminates exposure to non-sampling errors like non-response-bias.

- It is applied when there is difficulty in having censuses.

The sampling objective is to characterize the population under study through specific parameters, which can be means, totals, and proportions. You must also consider the sampling errors since information is obtained from the sample that probably would not coincide precisely if another alternative sample from the same population were selected.

What to Consider When Sampling?

When designing research that includes writing survey questions and considering sampling methods for online survey research, online focus groups, or other types of data collection methods that will likely prompt sampling methods related questions…

At a general level, with the market research sample, you should make decisions based on:

- The sample unit to be used? And with whom will sampling be used.

- What should be the size of the sample? How big should that sample be? How many people will be included?

- What sampling frames are available? What procedures will be used, and how will the people be selected for sampling?

having

What information is needed to choose the correct sampling method in research?

Choosing a sampling method requires stating the problem you are solving first. Practically speaking, this requires identifying the target population and being clear on the hypothesis or, instead, null hypothesis you are testing.

Begin with understanding the who, what, why, where, when, and how questions. Answers to the following example queries can help you determine the target population to sample and identify a source or sample frame:

- To whom should I market my product or service, and how will they respond?

- What impact is my candidate’s message having on moving the needle?

- How will my employees react to a compensation change?

- Which fundraising campaign will be most accepted, or where will dollars be most impactful.

These and many similar questions typically drive an organization’s desire to conduct market research, political research, or organizational research. Thus, you can be confident in designing the proper test and picking a sampling methodology to support your research goals.

What types of sampling methods are appropriate for online research?

When using internet data collection tools and deciding upon a sampling methodology, there is fundamentally no difference in your range of choices (whether probability or non-probability sampling). The theory (basic methods) is not applied differently from other methodologies, such as phone or mail surveys. It will be up to your ability to create a sample frame using the online medium that supports the sampling plan.

For example, if you want to do a simple random sample using an invite sequence to members selected from a list of email addresses of all members of a professional association, then you can accomplish this.

Another example of a non-probability sample would be using a list of all customers that serviced their Subaru Legacy in the past three years, sending out 100,000 invitations to take the survey, asking them about their satisfaction, and closing it after the first 100 responses. This methodology would be considered convenience sampling.

For decades into the internet research age, many research professionals still rely on offline data collection methods despite their high cost, non-response bias, and other inefficiencies. Yet, there are still legitimate use cases for these tools today.

With the popularity of online research, principally due to its speed, relatively lower costs, and access to targeted audiences, many research practitioners ask:

What kind of sampling method is an online survey?

The answer to this question highlights the main point of what this sampling article seeks to address, regardless of data collection medium: internet, phone, mail, door to door, or telepathy – it is the way you sample and not the data collection medium that is important.

All mediums have limitations and also strengths with regard to each sampling method for each given use case.

Please consider if you are doing online qualitative interviews in:

- China,

- Cincinnati or,

- Katmandu,

or quantitative online surveys with,

- N=100 Alaskan crab fishers or,

- Brand tracking with N=7000 13 to 39-year-old millennials every month,

any of the project samples for the examples mentioned above may be a good fit for online research, and independently each of those may be different sampling methods. The panel provider you work with should address how they design and select sample frames for your specific research.

Use this Sample Size Calculator to Estimate Your Sample Size

- Population total: Give the number of people that your survey results will be representing. This is not your sample size, but the entire population you are trying to represent. Examples would be The State of California (39.51 million) or Pacific Gas & Electric (PG&E) customers (16 million). Enter your target population total.

- Margin of error: The margin of error represents how precise your results will be. The margin of error represents the difference in proportion from the true proportion that is acceptable to the researcher. In the social sciences, five percent is an acceptable margin of error. You can change the margin of error depending on your precision needs. If you have no preference, choose five percent default. Sample size increases as the margin of error decreases.

- Confidence level: Select the reliability level. In statistics, this a measure of the reliability of a result. A confidence level of 95 percent means there is a probability of at least 95 percent the result is within a given range. Increasing the confidence level will increase the sample size.

What types of sampling methods for research should you consider for your study design?

The principal methods used by market research experts are probability and non-probability sampling.

Within both of these categories are subgroups that define how to obtain your sample more clearly, each carrying its own advantages and disadvantages for the researcher seeking the data.

What are probability sampling methods, and how are they used?

The sample units are selected through random processes in probability sampling. In this type of sampling, each element of the population has the same probability of being chosen. It is based on the equal probability principle, that is, all individuals are equally likely to be chosen to form part of a sample, and consequently all possible sample sizes have the same probability of being chosen.

Probability sampling methods ensure that the samples drawn are representative of the population, and, therefore, they are recommended. It is possible to know the margin of error and the level of confidence.

Four probability sampling methods used in market research

Simple Random Sampling Method

There are generally two principal ways to make a random selection when building a sampling frame. When the sample size is smaller, one standard method is to use simple random sampling, which gives every individual in the target population an equal chance of being selected by generating a series of random numbers.

This is one of the most common sampling methods in market research in which all the elements (people, organizations, etc.) of the population to be investigated have the same chance of being selected for the sample.

For example, let’s say we have 10,000 members of our hiking club, and we want to survey them to explore new trail destinations (but we don’t want to read 10,000 reviews). We can decide to send the survey to a simple random sample of 400 “fans” to make sure that we will have a response from all types of members.

Simple random sampling is commonly used to identify customer satisfaction (opinion surveys), members of organizations (general exploratory surveys), etc.

When you have a larger population, deploy a systematic approach described below or use cluster or stratified methods.

Cluster Sampling

Cluster sampling involves two stages. In stage one, the market researcher selects a certain number of groups or clusters of people to question or interview. In stage two, a random sample within each cluster is selected for the actual study.

Cluster sampling works best when a random sampling method of an entire population is too expensive, impossible, or extremely complicated. This method is a less expensive and faster way to collect market research information. However, since it’s not a completely random sampling, you are more likely to generate a sampling error.

Unlike strata sampling, where each stratum has a unique characteristic (sex, age, region, organization size, etc.), clusters or groups are the opposite. It is about making groups similar to each other. This method is used when we have technical difficulty in accessing all types of subjects in our population.

A cluster or a conglomerate is a “typical” group of our population; (that is, we could divide the population into X very similar groups, and then study only one or some of the groups exhaustively (all its subjects or making a random sample within the group).

One example of good use for this research sampling method may involve collecting customer preferences for a large, national hotel chain. It would be difficult, expensive, and time-consuming to collect information about every customer visiting every location of a hotel chain.

However, you can select a dozen locations around the country in stage one of a cluster sample and then randomly select guests at each of those 12 locations over the course of a month for your B2B research.

Perhaps you are collecting insights about new hotel services you’re thinking about adding. Customer preferences shared through such a cluster sample would probably be reasonably representative and usable for making such decisions.

Precision is not extremely important in this case, and therefore, the cost and time savings would outweigh the need for conducting a completely randomized survey.

Stratified Sampling

Stratified sampling is where the overall population is divided into mutually exclusive groups before a random sample is selected. You might want to subdivide your group by gender, race, income level, or age. Each person can only belong to one stratum or group.

For example, we see that among our clients, there are 60% women and 40% men. If we want to survey a sample with these proportions, we will design the sample carefully, for example, by investigating 600 women and 400 men in a total sample of 1000 people.

Businesses or organizations looking for a high level of precision or the ability to analyze information within smaller subgroups and the overall population may want to invest in stratified sampling. Since a representative group will be selected from each stratum, the actual sample can be smaller, saving time and money.

Customer Experience and Brand Tracking Studies are most often stratified to ensure representation from all customer segments. However, they may be defined.

Depending on your population and research goals, you’ll want to decide if you will use a proportionate or disproportionate stratification. Proportionate stratification can increase your precision because the actual sampling fraction of people will be proportionate to your entire population, which may not be the case in a completely randomized sample.

Disproportionate stratification can help market researchers when there are significant variances among the strata. You may gain precision for a particular survey measure; however, this precision may not carry across other components of the research.

Systematic Sample

Systematic sampling is an easy version of probability sampling because researchers select every nth individual on a population list. It is the technique that focuses on choosing a random selection of the first element for the sample.

Then later components are selected using fixed or systematic intervals until the desired sample size is obtained. As long as the population list does not contain any pre-organized groups, the resulting sampling should be representative.

This method of sampling is simple, fast, and effective in most market research situations. All that is necessary is a list of the population, a starting point, and a sampling interval.

For example, if you want to collect data from a trade association with 10,000 members, you can select every 100th person (sampling interval) on a membership roster to create a survey group of 100.

One example of a potential problem with systematic sampling would be a list that is organized before the sample is selected.

For instance, if you are questioning coaches and players of an adult sporting league about tournament locations, and the list is made up of team sub-lists that always place two coaches followed by 20 team members, you run the risk of either soliciting feedback from all coaches or no coaches depending on your interval selection.

What are non-probability sampling methods, and when are they used?

Non-probability sampling is, obviously, the opposite of probability sampling. Often referred to as purposive sampling collectively, the selection process within the various methods is not random, and therefore, subject to research to greater bias and more sampling errors.

The results of non-probability sampling are often helpful before or after a market research project involving probability sampling. For instance, the ideas generated can be used to create a quantitative survey for a randomized sample of your population. A non-probability sample can help flesh out and clarify topics that come out of a randomized survey.

Three non-probability sampling methods used in market research

Convenience Sampling Method

Convenience sampling is a quick and easy way to select your research subjects. Because they are the ones most convenient for your particular research project, this factor means that it’s faster, easier, and cheaper to conduct your research.

The major disadvantage is that, (depending on the type of convenience sampling you are using) you can introduce significant bias or sampling errors using this method.

One common example of convenience sampling is in a university setting, where graduate students use volunteer undergraduate students as experiments. In other cases, a researcher may select the people who happen to shop at a particular store on one day, mall shoppers, or the first dozen clients on a business’ customer list.

There are hybrids for convenience samples in online research where you draw random samples from a universe of participants with certain characteristics using behavioral data and other targeting methods. It’s a targeted convenience sample, but still random.

The question becomes low incidence categories: is it really better to screen through 10,000 people to get 100 people who qualify for a one percent incidence study? Most likely, it’s cost and time-prohibitive if you consider all the pros and cons.

Quota Sampling

In quota sampling, the researcher identifies groups that meet certain conditions, for example, age, sex, socio-economic level, depending on which feature is considered the basis of the quota. The number of individuals in each of the cells is defined. These types of cells are called quotas.

Categorized as a non-probability sampling technique, quota sampling enlists study participants until a relevant research category (or quota) has recruited enough respondents to reach holistic conclusions.

Unlike random sampling strategies, where every member of a target population has an equal chance of being selected, quota sampling relies more on convenience sampling. This means that researchers use their own judgment regarding how many people they need to survey to acquire reasonable and authentic results.

Snowball Sampling

Snowball sampling is generally carried out when there is a very small population. In this type of sampling, the researcher asks the first subject to identify another potential subject who also meets the research criteria. It is also known as chain sampling.

For example, a researcher decides to investigate samples made up of individuals with a rare disease. In this way, when finding an individual with these characteristics, the researcher asks for help finding other people with these conditions to make up the sample.

Judgmental Sampling

Judgmental sampling is a technique where researchers use their own rationale to select a sample based on personal knowledge and expertise. This produces a bias in the sample, but purposive sampling research methods can be useful when studying particular groups within the population.

If a researcher collects insights on patients suffering from a rare disease, it would make more sense to find those individuals directly. For an investigation of dog food, the researcher will select as a sample people accompanied by a dog. Another example is research on the behavior of parents with their children. In such a case, you will select people who have children as your sample.

The advantage of judgmental sampling is that you can question the exact type of person you’re seeking for your research project.

The major disadvantage is that you will most likely introduce human error and researcher bias into the results. As a result, it would be unwise to make generalizations about a larger population based on the results of a judgmental sample study.

Sampling methods conclusions

The concept of sampling or sampling techniques serves to extrapolate the data obtained to the population under study in market research. The objective of sampling is to obtain a sample from a population of interest most efficiently and reliably. You can use any of the sampling methods based on the nature of your research and the time and budget you have to conduct that research.

Once you’ve determined your market research project’s goals and objectives, you can make a smarter decision about which type of sampling methodology to use. As you can see from this primer, you need to balance your requirements for precision against the cost and time requirements of each sampling method.

If you’re seeking quantitative results, it’s best to use one of the probability sampling methods or hybrids.

If you are looking to conduct qualitative data analysis, one of the non-probability sampling methods may deliver the sample you need at a much lower cost and time investment. Working with a market research expert will help you better match your research requirements to the research sampling method and give you the greatest return on your investment.

Follow

OvationMR

Need help with new insights?

We are ready to offer you: