What Value Should You Place on Your Customer?

Knowing which customers to focus on and invest in is essential to your efforts to create a healthy business.

If you own a business, you’re aware that one customer differs from another in several ways. For instance, your customer may be a consumer, retailer, wholesaler, or purchasing department. What’s more, the budgets, frequency of purchases, and product or service requirements of each buyer within each of those groups vary. For example, one customer may limit her purchases to designer brands, while another buys only house brands.

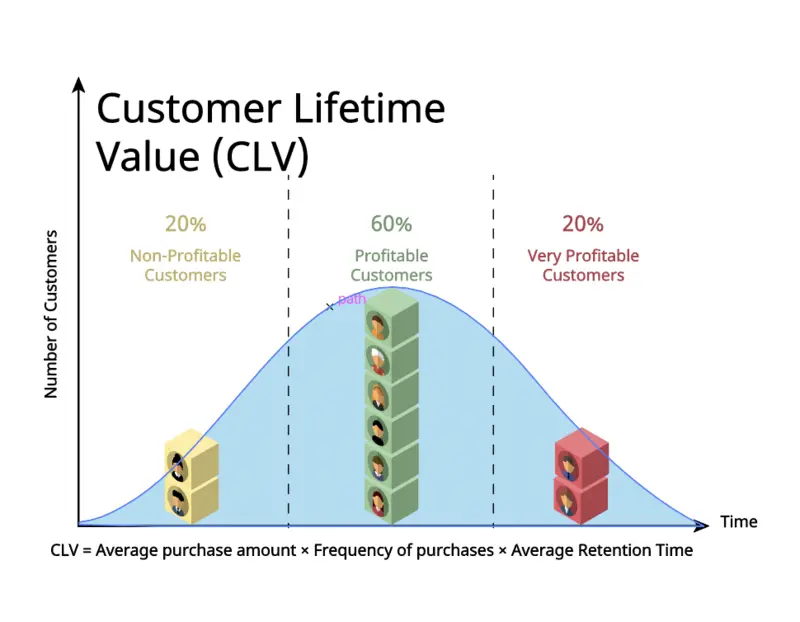

Consequently, knowing which customers to focus on and invest in is essential to your efforts to maximize profit. In part, you can answer this question using customer lifetime value figures.

You calculate one customer lifetime value (CLV) and then compare that figure to the CLV of other customers. (You can use a tool for this process.) These calculations and comparisons can guide your marketing and sales decisions and those of other functions touched by customer value considerations.

What Are the Benefits of Customer Lifetime Value?

For an entire organization and the marketing department, in particular, the ability to calculate a customer’s future value is no less intriguing than using a crystal ball to forecast sales. CLV offers a company several benefits:

- Cost/benefit analysis. CLV provides a quantitative means to gain a long-term perspective of the costs and benefits of customer acquisition for a market segment.

- Customer acquisition cost analysis. CLV sets an upper limit for new customer acquisition costs and evaluates marketing campaign performance accordingly.

- Marketing strategy. CLV imposes a specific economic discipline due to its focus on customer segmentation, retention, and monetization to assure both present and future profitability.

- Budget allocation. An average CLV serves as a forecast of the sales to a customer when preparing a budget. An average customer’s “spend” serves as decision support for investments in a company’s growth. Likewise, knowledge of the profit earned from sales to a company’s most active and loyal customers informs decisions for advertising, brand development, and other aspects of a marketing strategy.

- Revenue forecast. CLV results are input to a company’s revenue forecast. The figures based on loyal customers may suggest a reliable income stream for a certain period.

- Customer profile. CLV data informs a company as to who purchases what products. This information serves as input for formulating customer loyalty programs and decisions regarding customer segmentation. Once you identify the most and least profitable customers, you can segment your customer base accordingly. Next, you can develop your target marketing plan.

- Customer satisfaction. A successful customer retention effort depends on customer satisfaction. CVL data guides strategy in this regard. In turn, the customer retention effort is key to maintaining or increasing profit margins.

What Are the Disadvantages of Customer Lifetime Value?

CLV has some disadvantages:

- The CLV is less relevant to some products and services than others. A company that fosters long-term customers will benefit from calculating the CLV. But, the less frequent the introduction of new products and services, the less useful the CLV figures are.

- CLV data is not complete. CLV is a simple calculation with few factors. The calculations benefit from being combined with other metrics. Two such metrics are the net promoter score and the customer satisfaction score, each of which offers data about customer preferences.

- Predictions based on CLV may be inaccurate. An organization may falsely assume some outcomes are more likely than they are. Past behavior is not a determinant of future behavior. Basing all planning decisions on CLV, therefore, is unwise.

How Does a Company Improve CLV?

Several tactics can improve CLV:

- Improve the customer experience. A high level of customer service improves the customer experience, increasing the likelihood of a buyer becoming a long-term customer.

- Study the insights CLV provides. The CLV highlights some company characteristics that your customers favor. You can supplement the CLV data with information you gather using surveys and other feedback mechanisms.

- Create opportunities to increase the average order value. For instance, you might upsell and cross-sell your customers by offering bundles of products or related products. In these ways, the per-transaction dollar value rises.

- Establish a loyalty program. You can offer loyal customers discounts and create promotions that might increase customer loyalty and deepen your brand’s relationship with its customers. A loyalty program increases the lifetime value of customers.

No two customers are alike. One customer may provide 35 percent of your revenue, while another contributes only 5 percent. The problem is that the money you invest in acquiring both customers may be about the same. With customer lifetime value, you can invest more in those customers who contribute the most to your company’s profits.

To learn more about how you can improve the Life Time Value of your customer relationship using market analysis, brand tracking, and sales analysis measurement tools, Contact Us

Follow

OvationMR

Jim Whaley

Author

Jim Whaley is a business leader, market research expert, and writer. He frequently posts on The Standard Ovation and other industry blogs.

OvationMR is a global provider of first-party data for those seeking solutions that require information for informed business decisions.

OvationMR is a leader in consistently delivering insights and reliable results across various industry sectors around the globe for market research professionals and management consultants.

Need help with new insights?

We are ready to offer you: