Semantic Differential Scale to Measure Audience’s Feelings

by Tyler Maher | Oct 30, 2021

Use Semantic Differential Scale to determine respondents’ feelings or emotions towards a topic or product/service

When developing surveys for market research purposes, it’s important to use the right type of question to get the information you are looking for. While a multiple-choice format may get you useful replies in some cases, they are not ideal for situations where you want to know how strongly your audience feels about something.

If your goal is to get an accurate idea of how passionate your audience is about a specific question or topic, using the semantic differential scale is often your best bet.

What is the Semantic Differential Scale

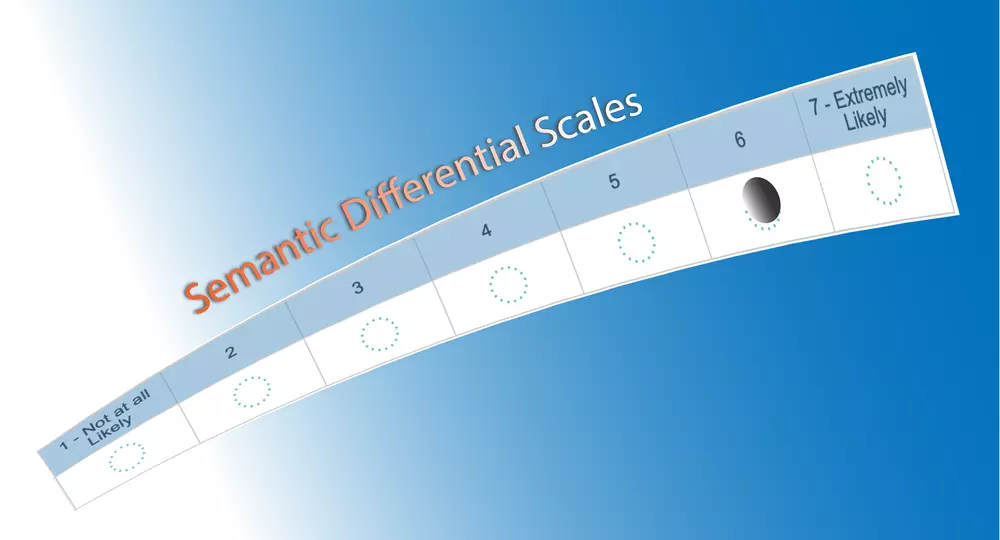

The semantic differential scale is a survey tool used to assess the “connotative meaning” of your audience’s answer. The scale is accepted as a reliable way to gauge the emotional impact of the question you are asking in a way that can be easily measured. Instead of asking your respondents to select between multiple individual responses, you instead ask them to choose where they stand on a range between two extremes.

For example, say you are conducting research in order to decide whether to open a new Mexican restaurant in your neighborhood. You could create a survey with the following question:

By asking the question in this way, you may get some insight into how many people in your area would even consider trying your new restaurant. However, one thing that is missing from this equation is how excited they would be to try your restaurant. After all, there is a lot of difference between someone who may consider trying a restaurant and someone who is enthusiastic about it.

This question using the semantic differential scale does a much better job of capturing your audience’s attitude toward a new Mexican restaurant.

As you can see, the scale depicted above give the respondents a a choice at either end of the scale which are “polar adjectives”, meaning they are true opposites. Formatting the question in this way with adjective pairs at either end of a 7-point scale gives your respondents room to not only indicate whether or not they would be willing to give your new restaurant a shot it also allows them to show you how enthusiastic they would be about it.

History of the Semantic Differential Scale

Charles Edgerton Osgood invented the semantic differential scale in 1952 while working as a Professor of Psychology and Communications at the University of Connecticut. He realized that the research techniques were not effective at capturing attitudes related to social and cultural issues.

In 1958, Osgood was paid nearly $200,000 by the CIA to conduct a worldwide study in which they tested attitudes toward over 600 keywords to see their connotation across several different cultures. This research was conducted as part of the controversial MK Ultra program. The CIA later used this influential research to create more efficient propaganda in foreign countries.

Advantages of Using the Semantic Differential Scale in Surveys

Learning about your audience’s emotional attitude towards the topics you are interested in asking them can yield vital insights. For example, the strength of this response can go a long way in assessing intangible qualities like loyalty and trust.

One of the most significant advantages of using the semantic differential scale is it’s easy to understand. As a result, it is one of the most popular types of questions seen on surveys. As a result, most respondents are very comfortable answering them, which means that the information collected using these questions is reliable. Semantic differential questions are also some of the easiest and fastest to write.

Tips for Writing Semantic Differential Questions

When analyzing results from the first semantic differential scales using factor analysis, Charles Osgood found that three types of scales were the most effective across all languages and cultures. Here is a rundown of each one and some examples.

Using the example questions above, the restaurant owner can get a much deeper understanding of the mindset of your customers than asking a series of “yes” and “no” questions. For instance, they may learn that a customer’s impression of how expensive their meal had an enormous impact on how much they enjoyed it, or maybe very little.

Making sure you include scales in each of the three categories is an excellent way to ensure a complete understanding of how your survey audience thinks.

The Semantic Differential Scale vs. The Likert Scale

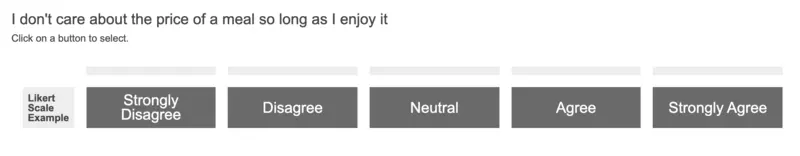

Similar to the semantic differential scale, the Likert scale presents a statement of opinion and then asks the survey taker how strongly they agree or disagree with the statement. Thus, the Likert scale is proper when you want to ask more complex questions.

As an example, you could combine multiple aspects from the previous section’s examples into a single 5-point scale question like this:

While questions using the Likert scale are an excellent tool for learning how your audience feels about specific opinions, including a statement of opinion makes it much more prone to bias than most other survey questions. Therefore, you’ll want to be very careful when writing these.

Best Practices in Survey Question Writing

No matter the types of questions included in your survey, writing them well is arguably the most important thing you can do to ensure accurate results. After all, if your questions are biased or hard to understand, your survey results will almost always be tainted.

Creating good questions for a survey may seem simple at first, but it is a deceptively complex process that requires time and effort. Here are some tips for making sure you end up with data that can be trusted.

Consider Your Survey as a Whole

Each question in your survey does not exist in a vacuum. Previous questions may have an impact on how survey respondents answer questions later in the survey. One good way to measure the effect on the order of your questions is to conduct a small pilot test before your study in which the questions are presented in a different order.

Every Word is Important

Slight differences with the wording of a question or the information provided in a question can drastically impact the results. A good example was in 2019 when Pew Research conducted an experiment in which they asked half of their respondents, “Are there plenty of jobs in your area?” The other half were asked, “Are there plenty of good jobs in your area?”

As you may guess, the addition of “good” profoundly impacted the survey results. 60% of respondents answered yes to the original question without the extra word. Only 48% who took the survey said there were good jobs in their area.

Open-Ended vs. Closed-Ended Questions

While multiple-choice surveys are quick and easy to answer, they may influence the results by providing responses that your respondents may not have thought about on their own. This is not a problem by itself, but it’s essential to consider when crafting questions and responses.

Open-ended questions that ask your survey-takers to fill in the blanks can ensure that every answer comes from the participant’s brain alone but may also introduce some issues of their own. Notably, filling out answers requires a lot more effort, so your respondents may get fatigued faster. Also, especially in surveys with a small sample size, it can be tough to make sense of the data if the answers are too scattered.

Planning – The Key to Successful Market Research

As you have probably gathered, there is far more to creating an effective survey questionnaire than it would appear at first glance. This is why it’s essential to take your time and think ahead when planning your next online research project. If your survey is distributed with biased or flawed questions, no amount of weighting survey data or clever analysis after the fact will be able to salvage your data.

Want expert help accessing targeted consumer or B2B audiences or planning your next market research panel study?

Contact Ovation Market Research today, and we’ll show you how we can help save time and money while getting fast and reliable data from your ideal audience.

Follow

OvationMR

Tyler Maher

Author

Tyler Maher is a Research Manager at OvationMR and posts regularly on The Standard Ovation.

OvationMR is a global provider of first-party data for those seeking solutions that require information for informed business decisions.

OvationMR is a leader in delivering insights and reliable results across a variety of industry sectors around the globe consistently for market research professionals and management consultants.

Visit Us: www.ovationmr.com

Resources

Calculators

Resources

Calculators

Visit Us:

- 101 Avenue of the Americas

- 9th Floor, Suite 908

- New York, NY 10013